With the ever-changing landscape of real estate, understanding the costs involved during selling your home presents a challenge by homeowners. Entering the market throughout 2025 presents unique challenges and opportunities, requiring careful consideration of expenses.

It's essential to factor in common costs such as realtor commissions, closing fees, and likely repairs. However, be prepared by means of unexpected expenses that could potentially happen.

Volatile market conditions can influence the selling price and overall transaction costs.

Staying up-to-date about current market trends, seeking advice from a reputable realtor, and developing a comprehensive budget are essential steps in navigating real estate costs effectively. Remember, meticulous planning is essential for you by means of reaching an informed and home sale in 2025.

Deciphering the 2025 Seller's Expenses: A Comprehensive Guide

In the dynamic realm of real estate, savvy property owners must meticulously evaluate their potential expenses to ensure a profitable sale. As we embark on 2025, several elements will mold the financial landscape for those looking to sell their assets. This comprehensive guide aims to unveil the key costs that property owners should be aware of in 2025.

- Typical costs include brokerage costs, property conveyance fees, and settlement expenses.

- Furthermore these conventional expenses, vendors may also face unforeseen expenses such as upgrades or judicial expenses.

- Understanding the nuances of these charges is vital for sellers to make informed choices and optimize their financial gain.

Hence, it is imperative for property owners to meticulous research and engage the expertise of experienced brokers to traverse the complexities of 2025's transaction costs.

Selling in 2025: The Ultimate Cost Breakdown for Homeowners

Thinking about selling/listing/moving your home in 2025? It's a dynamic/competitive/evolving market, and understanding the associated expenses/costs/fees is crucial. From traditional/contemporary/innovative marketing strategies to legal/closing/transactional procedures/requirements/steps, there are numerous/various/multiple factors that can impact your bottom line.

- First, let's consider/explore/examine the costs of listing/commissions/agent fees. These typically range from 3% to 6% of the sale price/a percentage based on your home's value/a fixed fee structure, depending on your local market/region/area and the services provided by your real estate agent/broker/professional

- Next, factor in/Don't forget about/Account for the expenses of staging/preparation/enhancement.

Planning 2025 Home Sale Budget: Essential Fees & Hidden Costs Revealed

Selling your dwelling in 2025 is a big decision, and Miami and Fort Lauderdale real estate market trends it's crucial to know the costs involved. While the initial price may seem like the biggest expense, there are plenty of additional fees that can increase your total expenses.

Here's a breakdown of important fees to include in your budget:

* **Real Estate Agent Commissions:** Typically ranging from 4% to 6%, these commissions involve the agent's help.

* **Closing Costs:** These charges can vary widely depending on your location and transaction. Expect to allocate for title insurance, escrow fees, appraisal costs, and recording fees.

* **Staging Costs:** To make your home more appealing, staging services can be beneficial.

* **Repairs & Renovations:** Essential repairs and updates can help increase your market worth.

Don't ignore these hidden costs:

* **Prepaid Property Taxes:** You may need to cover any outstanding property taxes at closing.

* **HOA Fees:** If you live in a community with an HOA, you'll likely need to pay any outstanding fees.

By thoroughly planning your budget and understanding all the expenses, you can guarantee a smooth and successful home sale in 2025.

Listing a House in 2025: The True Cost

Predicting the exact cost to sell a house in 2025 is like forecasting the weather months in advance - there are just too many variables at play. Market fluctuations, interest rates, and even local real estate trends can all have a significant impact. That said, we can offer guidance on the typical expenses you can expect to face when selling your home.

First, there are the common closing costs, which typically range from 5% to 7% of the final sale price. This covers fees for things like appraisals, title insurance, and escrow services. Then there's the question of real estate agent commissions, which can vary depending on your location and the agent's experience. Generally, expect to pay between 5% and 6% of the sale price in commission fees.

Of course, these are just the baseline costs. You might also need to factor in additional expenses like home repairs, staging expenses, or even professional photography.

It's crucial to consider that every house sale is unique, so it's best to consult with a local real estate professional for a more precise estimate of the costs involved.

Navigating the 2025 Housing Landscape: Unveiling the Hidden Expenses of a Sale

As we brace into the unpredictable real estate market of 2025, understanding the full costs of selling is crucial. Beyond the traditional fees like realtor commissions and closing charges, a multitude of often-overlooked expenses can significantly impact your bottom line.

- For instance, consider the costs of staging your home to attract buyers and professional photography to showcase its best features.

- Furthermore, don't ignore potential repairs or upgrades needed to fulfill market demands.

- Finally, remember that unexpected expenses can happen during the selling process, so it's strategic to allocate a financial cushion.

By thoroughly evaluating all potential costs before listing your property, you can navigate the market successfully.

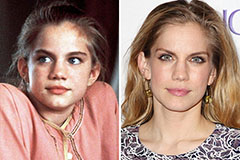

Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! David Faustino Then & Now!

David Faustino Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now! Dolly Parton Then & Now!

Dolly Parton Then & Now! McKayla Maroney Then & Now!

McKayla Maroney Then & Now!